The Fed moneyprinting drugging of the stock markets

Zero Hedge, 22 August 2020

style="width:1080px;height:540px;">

see:

www.zerohedge.com/markets/roberts-march-was-correction-bear-market-still-lurks

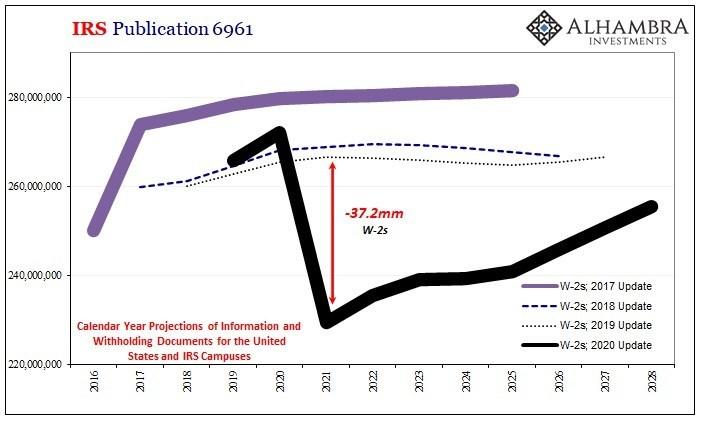

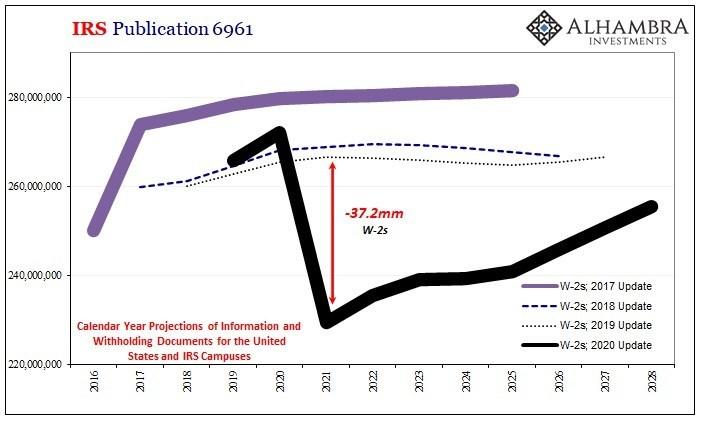

IRS predicts over 10,000,000 pernamently lost jobs in the next decade

Zero Hedge, 22 August 2020

see:

www.zerohedge.com/personal-finance/these-are-real-huge-jobs-numbers-and-they-will-make-your-blood-run-cold

Since the DotCom crash, companies have been cooking-the-books by gradually lowering their "effective tax rate", helping boost EPS or after-tax profits in relation to the actual profit growth generated from top-line economic activity and innovation

Zero Hedge, 19 August 2020

see:

www.zerohedge.com/markets/earnings-gap-why-sp-500-against-clock

Just like before the DotCom crash, SP500 is shooting way above SP500 earnings estimates

Zero Hedge, 19 August 2020

see:

www.zerohedge.com/markets/earnings-gap-why-sp-500-against-clock

If Dow reverses and drops from 27835 to around 26000, it will be tracking the Dow during the first two years of the Great Depression

Wall Street Journal, 17 August 2020

see:

www.zerohedge.com/markets/chart-day-bearish-setup-doubles-down

Gold behaves similarly to a three-times leveraged version of 10-year Treasury inflation-protected securities (TIPS) since 2002

Wall Street Journal, 17 August 2020

see:

www.wsj.com/articles/gold-will-need-more-bad-news-to-keep-prospering-11597492800

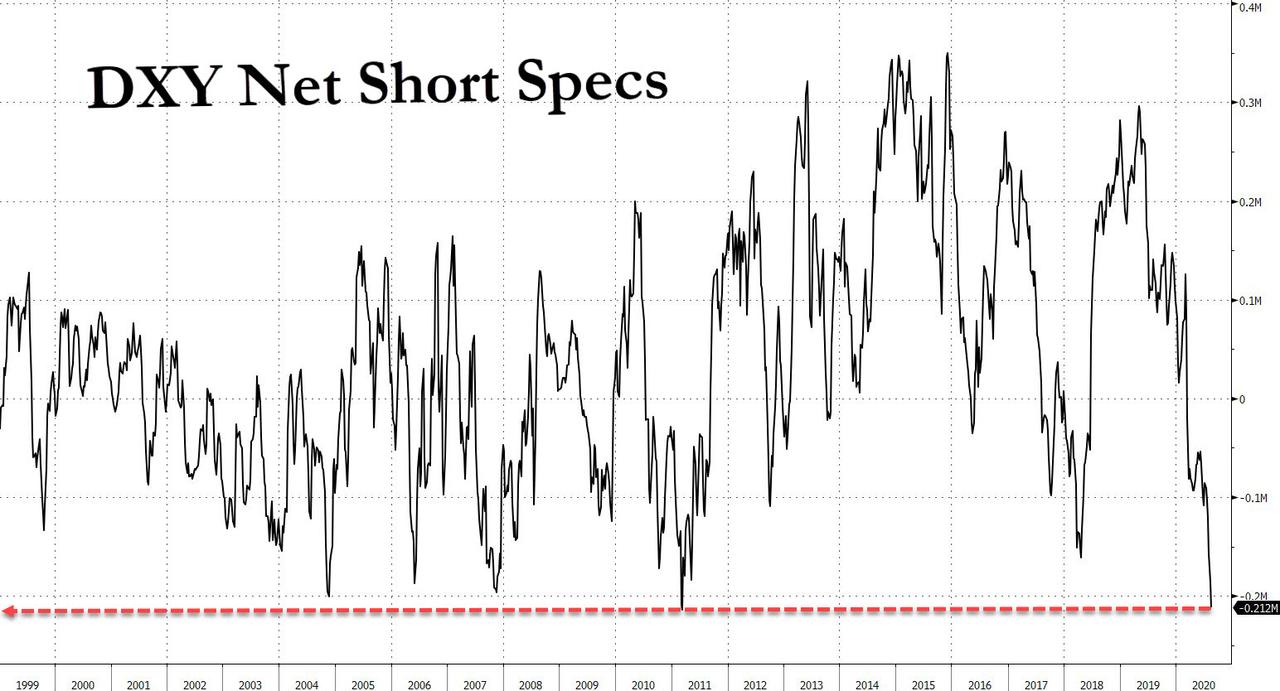

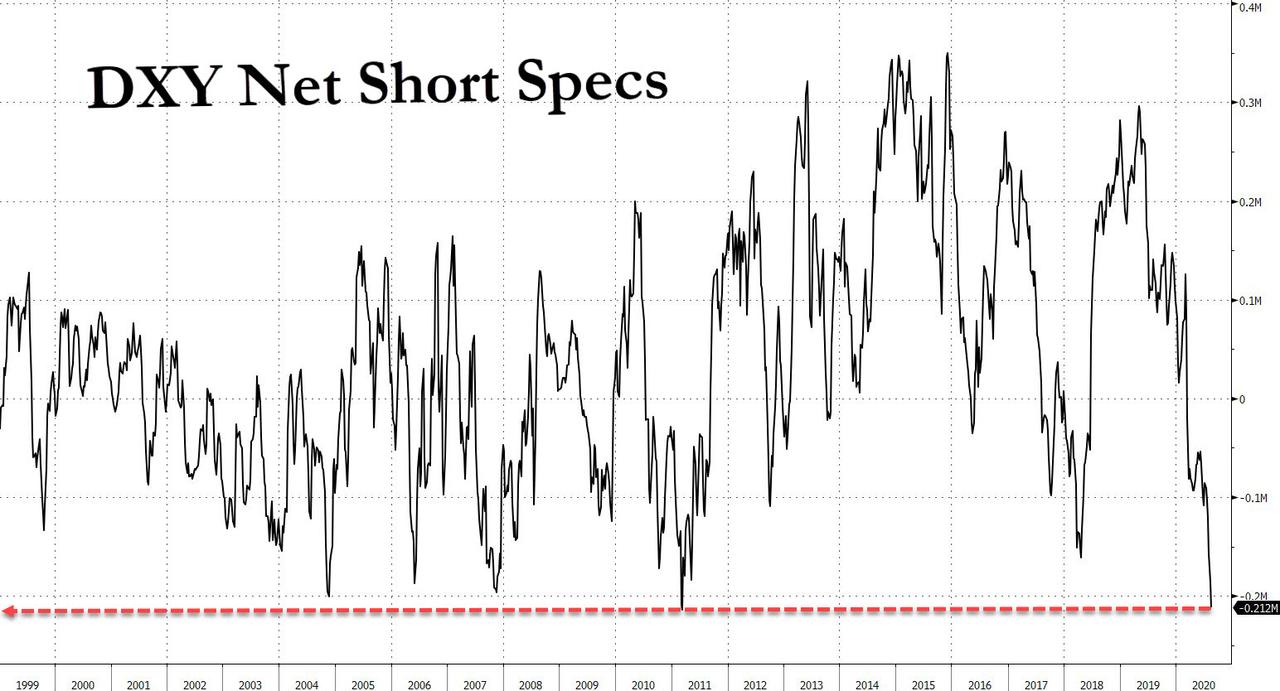

US Dollar futures most shorted since 1999 - time to go long

Zero Hedge, 16 August 2020

see:

www.zerohedge.com/markets/short-dollar-now-worlds-most-consensus-trade-so-its-time-go-long

Zhōngguós' credit impulse forward correlation with 10-year real Treasury rates suggests the real rates will rise, pushing down gold prices

Zero Hedge, 14 August 2020

see:

www.zerohedge.com/markets/chart-day-china-about-unleash-inflationary-tsunami-us

Silver's chaos of the last couple of days sent SLV (the Silver ETF) to the steepest discount to NAV since Lehman (Oct 2008)

Zero Hedge, 12 August 2020

see:

www.zerohedge.com/markets/mega-cap-tech-stocks-soar-again-reflation-rotation-ends-abruptly

Since March 2020, the SP500 has pretty much tracked the Global Liquidity Proxy

Zero Hedge, 12 August 2020

see:

www.zerohedge.com/markets/mega-cap-tech-stocks-soar-again-reflation-rotation-ends-abruptly

Since March 2020, the SP500 has been widely divergent way above consensus earnings

Zero Hedge, 12 August 2020

see:

www.zerohedge.com/markets/mega-cap-tech-stocks-soar-again-reflation-rotation-ends-abruptly

SP500 mostly has been tracking the PMI and Earnings Revisions since 2000

Zero Hedge, 10 August 2020

see:

www.zerohedge.com/markets/why-morgan-stanley-expects-10y-yields-be-much-higher-over-next-3-6-months

Spot gold prices still tracking the inverse of the 10-Year Treasury bond Real yield

Zero Hedge, 10 August 2020

see:

www.zerohedge.com/markets/predicting-price-gold

Since the beginning of May, the SP500 has risen 314 in the overnight session, and nothing in the day session

Zero Hedge, 17 July 2020

see:

www.zerohedge.com/markets/craziest-chart-youll-see-today

The strong correlation between the SP500 and permanent job loss

Zero Hedge, 05 July 2020

see:

www.zerohedge.com/markets/permanent-job-losses-will-be-rude-awakening-stock-market

Nasdaq 100 Index continues to steadily rise above a huge gap with the US Continuing Jobless Claims index

Zero Hedge, 02 July 2020

see:

www.zerohedge.com/markets/might-be-craziest-thing-ive-seen-my-stock-market-career

SPY/GLD ratio over last 2 and 10 years suggest SP500 to drop futher

Zero Hedge, 22 June 2020

style="width:720px;height:540px;">

see:

www.zerohedge.com/markets/watershed-moment-gold-signaling-stocks-now-shaky-footing

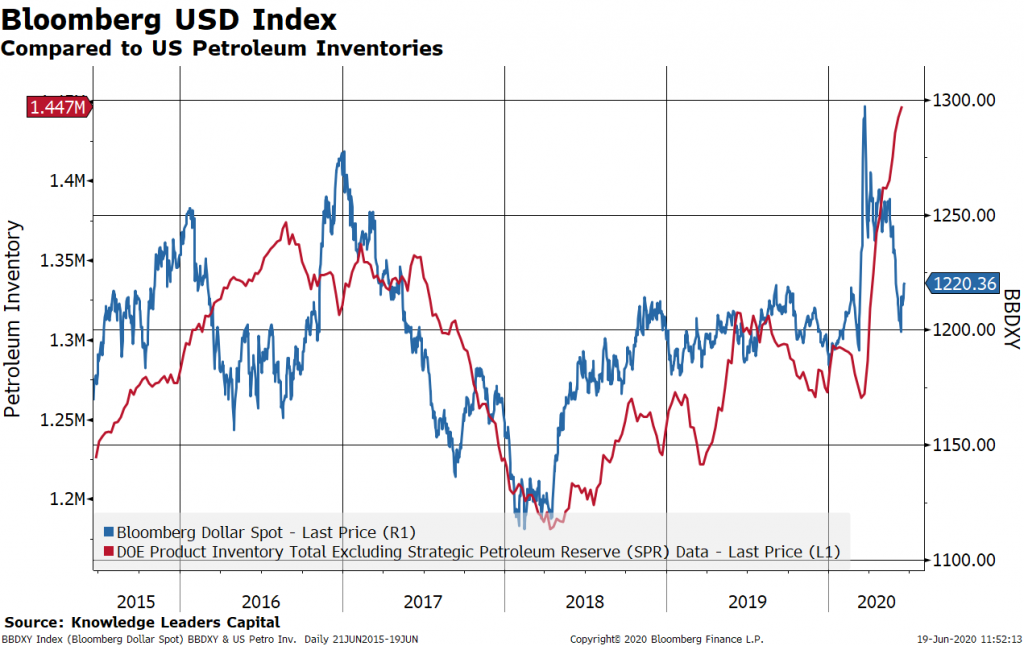

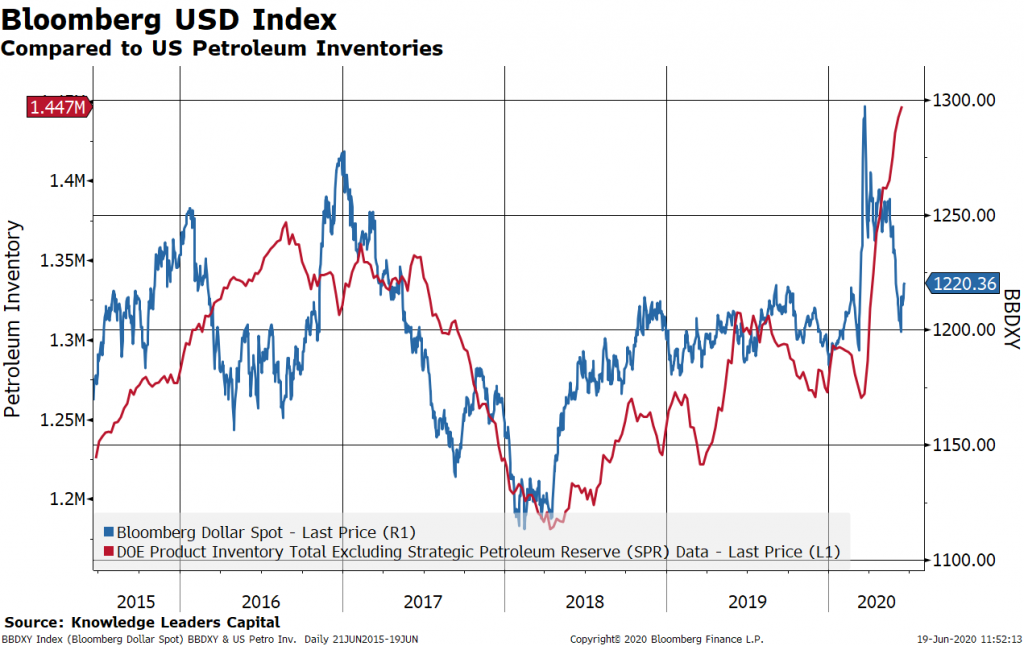

Despite a gargantuan $18+ trillion in fiscal and monetary stimulus, a credit growth which have historically been good indicators of underlying GDP growth, the current sharp divergence between credit and activity observed in the US, the eurozone and China is particularly unusual and highlights how different this crisis is relative to the 2008 financial crisis

Zero Hedge, 19 June 2020

see:

www.zerohedge.com/markets/ready-another-usd-rally

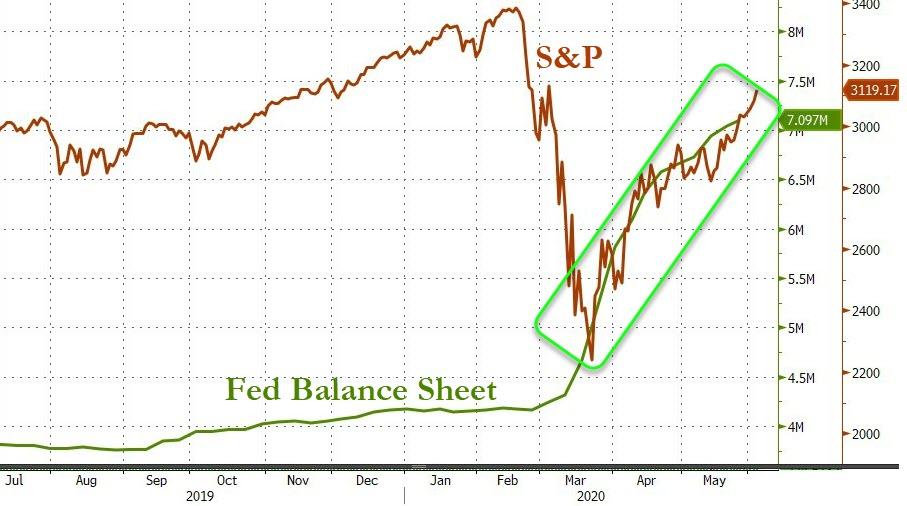

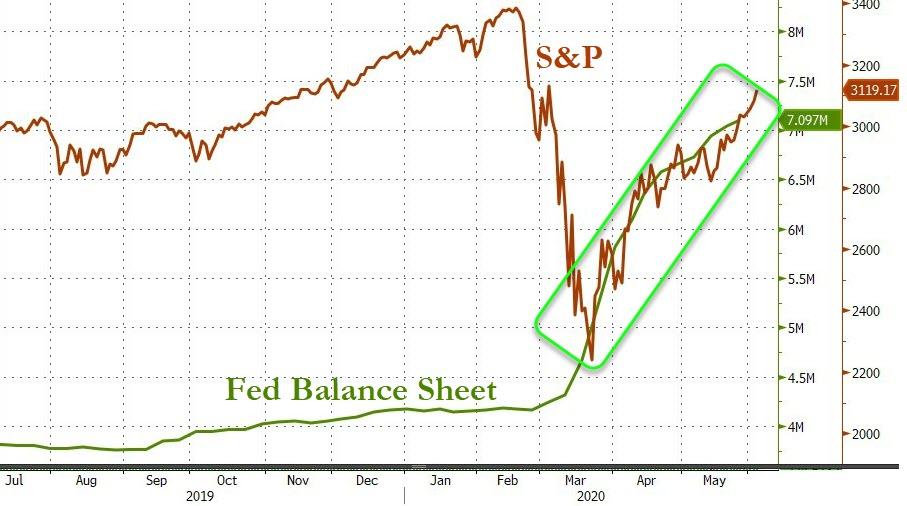

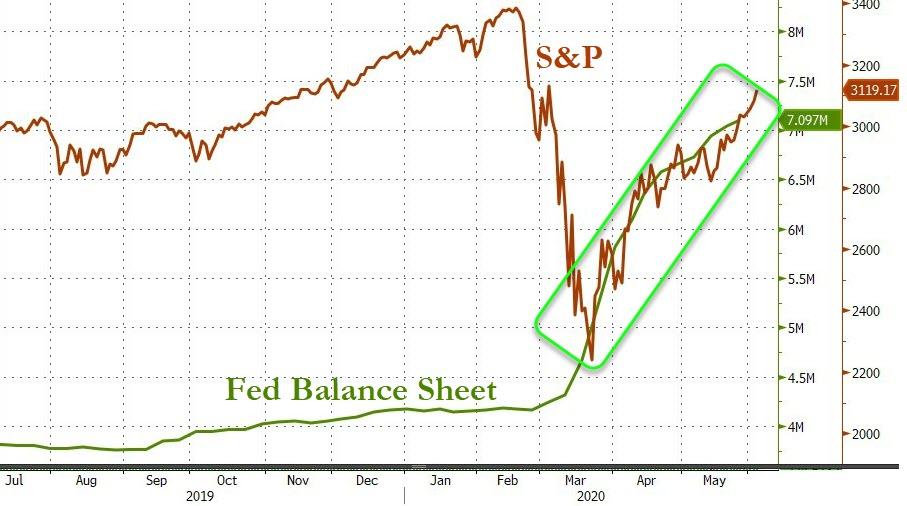

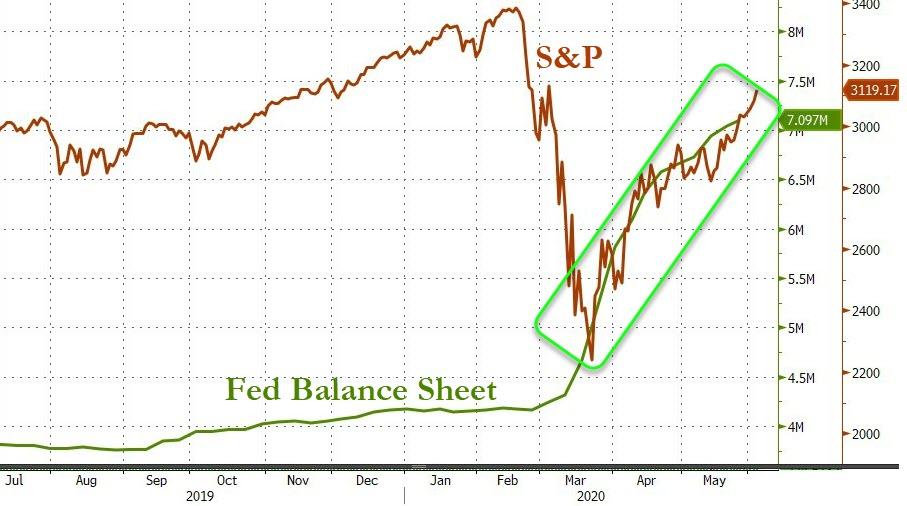

With the Fed Balance Sheet mostly correlated with the SP500 since March, as the balance sheet declines, will the SP500 decline?

Zero Hedge, 19 June 2020

see:

www.zerohedge.com/markets/feds-balance-sheet-posts-biggest-drop-11-years

How the price of gold has tracked the US M2 money supply since the 1980s

Zero Hedge, 14 June 2020

see:

www.zerohedge.com/commodities/how-are-gold-and-money-supply-related

SP500 Railroad stocks index diverges sharply higher while Total US Railroad Freight Carloads index plummets - insane divergences

Zero Hedge, 09 June 2020

see:

Nasdaq volume hits all time high as put-to-call ratio craters - no need to buy call options for insurance while the Fed is propping up the markets

Zero Hedge, 05 June 2020

see:

www.zerohedge.com/markets/record-stampede-stocks-nasdaq-volume-hits-all-time-high-put-call-ratio-craters

Momentum/value ratio crashes and converges to the 30-year Treasury yield - if these interest rates go above 0.84, CTAs could close the long Treasury contracts, sending rates up and causing some equity monies to move to bonds

Zero Hedge, 05 June 2020

see:

www.zerohedge.com/markets/quant-carnage-momentum-melts-down-most-record-yields-spike

Federal Reserve moneyprinting and flooding the markets with liquidity is the ONLY thing propping up the SP500 - not economics, not growth, just money counterfeiting

Zero Hedge, 04 June 2020

see:

www.zerohedge.com/markets/gold-gains-bonds-stocks-dollar-are-dumped

Small cap stocks are the more overvalued ever - the Small Cap (SP600) Forward P/E/ ratio is the highest ever since 1995, and nearly double the height at the 2008 financial crisis

Zero Hedge, 04 June 2020

see:

www.zerohedge.com/markets/gold-gains-bonds-stocks-dollar-are-dumped

A staggering measure of the Fed's socialist policies: the Nasdaq is trading at 152-times the Bloomberg Commodity Index, surpassing the DotCom bubble by a factor of two

Zero Hedge, 04 June 2020

see:

www.zerohedge.com/markets/staggering-powell-bubble-just-one-amazing-chart

The stock market has reached its "maxiumum stupid" price limit, with the small-cap Russell 2000 at a 30-year nose-bleed high of 70 for its P/E ratio

Zero Hedge, 01 June 2020

see:

www.zerohedge.com/markets/its-decision-time-market-has-reached-its-maximum-stupid-price-limit

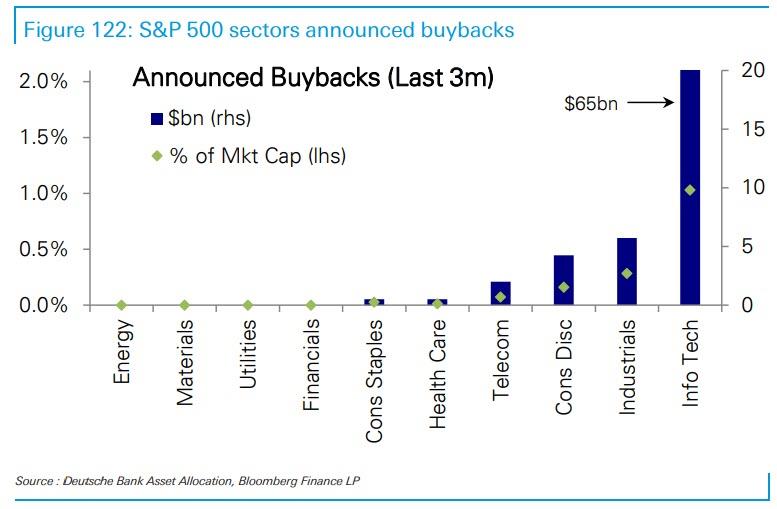

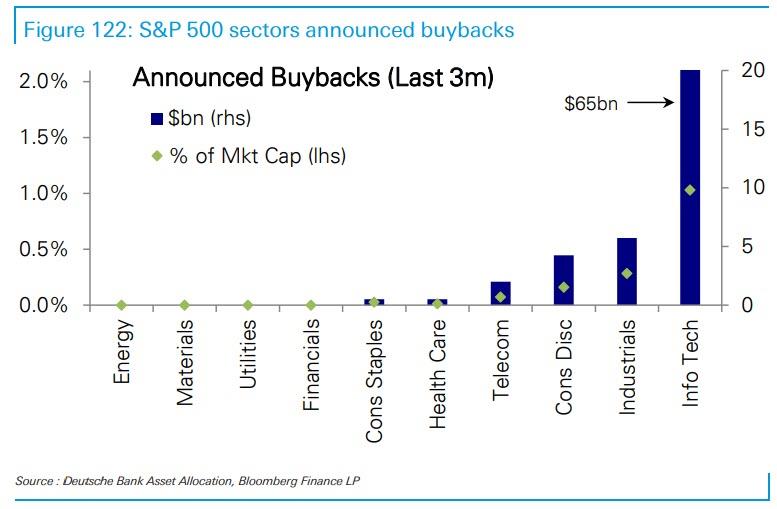

Only the stocks of the huge tech companies are up because only they have the cash for tens of billions of dollars of stock buybacks

Zero Hedge, 31 May 2020

see:

www.zerohedge.com/markets/buybacks-are-back-heres-who-repurchasing-most-stocks

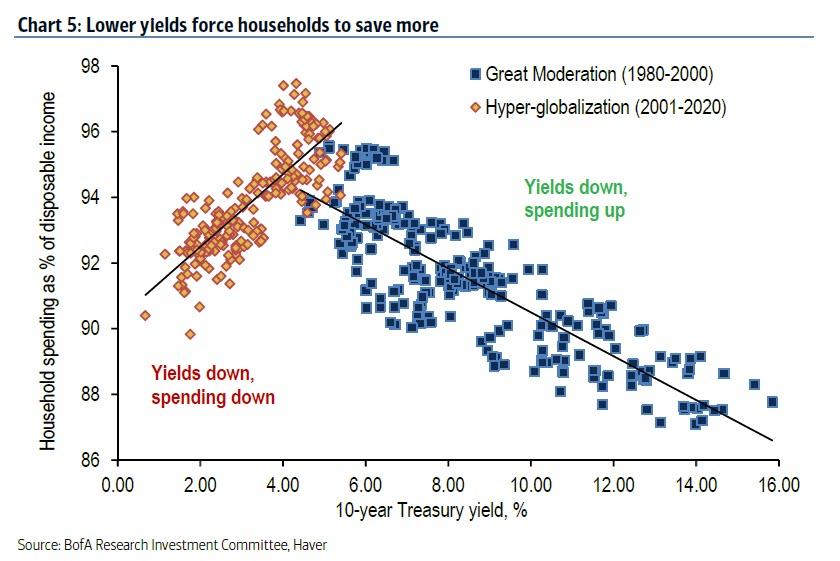

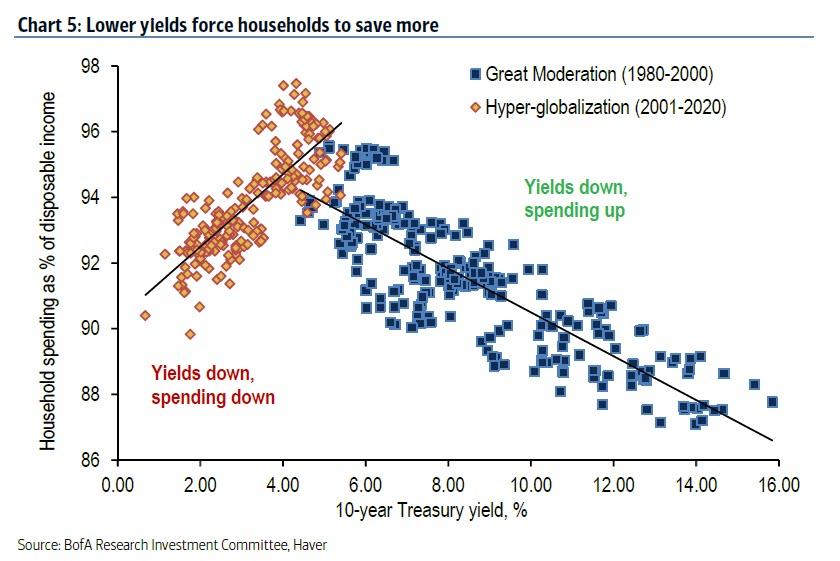

Persistently low Treasury Bond yields (< 4%) are forcing Americans to spend less as they need to save more for retirement - forced saving further depresses demand in a vicious cycle which depresses corporate earnings

Zero Hedge, 31 May 2020

see:

www.zerohedge.com/markets/here-stunning-chart-blows-all-modern-central-banking

Silver still underperforming gold, though gold/silver is tracking the US dollar index, while gold is still cheap against global money supply since 2012

Zero Hedge, 28 May 2020

see:

www.zerohedge.com/commodities/silver-shines-gold-glut-weighs-barbarous-relic

After March's collapse, April's durable goods orders weakness accelerated, with preliminary data plunging 17.2% MoM (worse than the 16.6% decline in March). This sent durable goods orders down 19.4% YoY - the worst since the financial crisis.

Zero Hedge, 28 May 2020

see:

www.zerohedge.com/economics/collapse-us-durables-goods-orders-accelerates-april

In May, you could only make money buying stocks if you traded in the overnight sessions

Zero Hedge, 27 May 2020

see:

www.zerohedge.com/markets/if-youre-buying-stocks-during-us-day-youre-doing-it-all-wrong

Stock market returns over the next 10 years should average 0%, based on historical data

Zero Hedge, 27 May 2020

see:

www.zerohedge.com/markets/why-credit-suisse-sees-0-returns-over-next-decade

The Federal Reserve has counterfeited $3.3 trillion dollars to give to the 1%, while having no effect on the economy for everyone else

Zero Hedge, 25 May 2020

see:

www.zerohedge.com/markets/tinas-orgy-anything-goes-winners-take-all

Small "retail" stock market investors have beaten hedge funds since last August - so what is the point of all the in-depth analysis conducted by hedge funds if 20-year-old retail investors armed with just an online trading platform and listening to CNBC can outperform them?

Zero Hedge, 24 May 2020

see:

www.zerohedge.com/markets/retail-investors-are-crushing-hedge-funds-again

Federal Reserve moneyprinting is the only thing pushing up forward earnings after the coronavirus market crash in March

Zero Hedge, 22 May 2020

see:

www.zerohedge.com/markets/bear-market-or-just-big-correction

US dollar rising against fiat currencies, but dropping against gold

Zero Hedge, 22 May 2020

see:

https://www.zerohedge.com/markets/path-monetary-collapse

In the last 15 days, US equities only go up after the cash markets close

Zero Hedge, 22 May 2020

see:

https://www.zerohedge.com/markets/easy

European equities continue trade poorly during European-only trading hours

Zero Hedge, 22 May 2020

see:

https://www.zerohedge.com/markets/easy

SP500 is forming a triple-top, three times failing to rise above the 2950 resistance level

Zero Hedge, 18 May 2020

see:

www.zerohedge.com/markets/sp-futures-fail-breakout-above-3000-triple-top-forms

2010-2021 corporate earnings keep on getting revised down

Zero Hedge, 18 May 2020

see:

www.zerohedge.com/markets/chase-momentum-until-fundamentals-matter

The US dollar still has a few years of rising against other currencies

Zero Hedge, 17 May 2020

see:

https://www.zerohedge.com/markets/anatomy-long-term-us-dollar-cycles

The 24-month-forward (not the usual 12-month tea-leaf-reading) P/E ratio is also at 20-year highs

Zero Hedge, 17 May 2020

see:

www.zerohedge.com/markets/goldman-quietly-cuts-q3-q4-eps-forecasts-now-values-market-2023-earnings

Why all economic growth in the Internet era (>1990) has been funded only by debt, not innovation

Zero Hedge, 17 May 2020

see:

realinvestmentadvice.com/macroview-why-siegel-is-wrong-about-end-of-bond-bull-market/

Gold mining stocks are at a 25-year-low against gold and the SP500

Zero Hedge, 17 May 2020

see:

www.knowledgeleaderscapital.com/2020/05/15/heres-5-reasons-why-gold-miners-have-massive-outperformance-in-the-tank/

Cass April Shipping index level drops back to 2009 levels

Zero Hedge, 15 May 2020

see:

www.zerohedge.com/economics/lost-april-and-failure-economic-cheerleading

The current SP500 rally looks eerily familiar to previous bear market rallies

Zero Hedge, 14 May 2020

see:

www.zerohedge.com/markets/battle-fibos-negative-yield-wall

If the leading technology index NASDAQ 100 closes below its 15-day moving average then we have potentially a significant breakdown of the uptrend that started in mid-March

Zero Hedge, 14 May 2020

see:

www.zerohedge.com/markets/crucial-session-stocks-nasdaq-15-dma-breach-signals-imminent-breakdown

The SP500 Fair Model index is still below the SP500 index price, two series with a history of reversion to the mean

Zero Hedge, 13 May 2020

see:

www.zerohedge.com/markets/putting-price-sp-500

SP500 has been above real corporate profits for over 10 years - increasingly too long and suggesting a convergence towards

Zero Hedge, 12 May 2020

see:

www.zerohedge.com/markets/stock-market-isnt-economy

Compared to history, the SP500 bouncing from recent lows is too high too quickly, which could mean a false bottom

Zero Hedge, 12 May 2020

see:

www.zerohedge.com/markets/bear-market-rally-or-new-bull-bofa-has-answer-and-what-happens-next

Core CPI crashes by most on record, as food costs soar while energy and clothing prices collapse

Zero Hedge, 12 May 2020

see:

www.zerohedge.com/markets/core-cpi-crashes-most-record-food-costs-soar-energy-apparel-collapse

World stocks are up for only one economic reason: central banks are printing huge quantities of money to buy everything

Zero Hedge, 11 May 2020

see:

www.zerohedge.com/markets/banks-battered-bitcoin-brusised-big-tech-buying-spree-continues

Consumers expectations of higher stock prices rises above 50% for the first time ever in history - despite the economy sliding into a recession

Zero Hedge, 11 May 2020

see:

www.zerohedge.com/economics/us-slides-depression-consumers-have-never-been-more-bullish-stocks

Another leg lower in stock market prices is coming, but what could leave traders speechless in 2021 is a big drop in the markets if earnings don't recover

Zero Hedge, 11 May 2020

see:

www.zerohedge.com/markets/another-leg-lower-coming-what-happens-2021-will-leave-traders-speechless

A familiar chart from 2019 and years prior: the SP500 levitates higher (chumps buying) even as investors pull money from stock funds, i.e., selling

Zero Hedge, 10 May 2020

see:

We have the largest (physical) silver coin premium since Bernanke disappointed the markets in 2011, and since Lehman sent investors scrambling in 2008

Zero Hedge, 09 May 2020

see:

www.zerohedge.com/markets/silver-coin-premiums-soar-signal-alt-money-demand-economic-recovery-hype-fades

Labor market slack likely to remain substantial even in late 2021

Zero Hedge, 08 May 2020

see:

As markets crashed, the hedge fund otherwise known as the Swiss National Bank went on a FAAMG buying spree

Zero Hedge, 08 May 2020

see:

www.zerohedge.com/markets/nasdaq-now-bigger-rest-worlds-stock-market

World stock index and global liquidity proxy index has a huge divergence away from low global sovereign bond yields - is economic growth strong or weak?

Zero Hedge, 08 May 2020

see:

www.zerohedge.com/markets/investors-need-be-mindful-bonds-stocks-suffer-biggest-disconnect

PEG Ratio (ratio of 12-month forward P/E to long-term EPS growth) is at 40 year high - "more shocking than a 20-times P/E ratio"

Zero Hedge, 08 May 2020

see:

www.zerohedge.com/markets/albert-edwards-one-chart-proving-just-how-insane-market-has-become

Record plunge in service sector "business activity" points to profits crash - the cale of the decline is far bigger than anything seen during the Great Financial Recession and signals a record drop-in service sector Q2 revenue and operating profits - correlation since 2008 sharply diverges

Zero Hedge, 07 May 2020

see:

www.zerohedge.com/markets/record-plunge-service-sector-business-activity-points-profits-crash

SP500 12 months forward P/E is the highest ever in the last 15 years, made worse by plummeting Earnings

Zero Hedge, 06 May 2020

see:

www.zerohedge.com/markets/stocks-have-never-been-more-expensive-disconnect-between-markets-and-reality-hits-idiotic

NASDAQ stock index is disconnected from reality, diverging against many other indicators

Zero Hedge, 05 May 2020

see:

www.zerohedge.com/markets/nasdaq-nears-unch-2020-employment-economy-earnings-collapse

GAAP earnings and GDP growth suggests markets will retest lows

Zero Hedge, 05 May 2020

see:

www.zerohedge.com/markets/will-market-retest-lows-summer

Trillions of dollars in new Federal debt no longer help grow the economy, and multi-trillion dollar deficits will make future growth difficult

Zero Hedge, 04 May 2020

see:

www.zerohedge.com/political/should-we-worry-about-government-debt

One "investing legend", Kiril Sokoloff, sees a second "Great Depression" for stocks by 2023, if the SP500 tracks the Dow Jones average from Oct 1918 to July 1933

Zero Hedge, 03 May 2020

see:

https://www.zerohedge.com/markets/investing-legend-sees-second-great-depression-stocks-2023

The 5 FAANG stocks are up 10% for the year, while the remaining 495 stocks in the SP500 are collectively down 13%

Zero Hedge, 03 May 2020

see:

www.zerohedge.com/markets/faamgs-are-10-2020-remaining-495-sp-stocks-are-down-13

The divergence down of the Dow Transports while the SP500 diverges up, suggests the SP500 has to regress to the level of the Dow Transport

Zero Hedge, 02 May 2020

see:

www.zerohedge.com/markets/if-bear-market-over-why-are-commodities-transports-underperforming

Bond market less optimistic about economy tha stock market

Zero Hedge, 01 May 2020

see:

www.zerohedge.com/markets/bond-market-hasnt-been-overcome-same-optimism-stocks

US GDP expected to contract 30-35% based on estimates by 17 investment analysts, in part due to drop in oil demand

Zero Hedge, 01 May 2020

see:

www.zerohedge.com/energy/berman-game-over-oil-economy-next

Gold is cheap relative to the global money supply

Zero Hedge, 01 May 2020

see:

www.zerohedge.com/commodities/silver-hasnt-been-cheap-5000-years-human-history

Only 3 times since 1990 was VIX above 30 outside of a bear market, and also above 30 about 6 months later, suggesting VIX futures are currently pricing new lows likely ahead for the SP500

Zero Hedge, 01 May 2020

see:

www.zerohedge.com/markets/here-one-indicator-convinced-bofa-another-market-crash-coming

Only 34% of consumers, which make up 70% of GDP, think that business conditions are normal, while the SP500 forward P/E multiple is at an 18 year high - a contradiction

Zero Hedge, 28 April 2020

see:

www.zerohedge.com/markets/us-consumer-confidence-collapses-richmond-fed-crashes-record-lows

Market breadth at lowest levels since the Tech Bubble of 2000

Zero Hedge, 28 April 2020

see:

www.zerohedge.com/markets/market-rises-economy-reopens-routs-riskreward

The stocks have yet to enter Phase 3 of bear markets

Zero Hedge, 27 April 2020

see:

www.zerohedge.com/markets/lessons-forgotten-are-relearned-during-bear-markets

Silver/Gold ratio, at over 110, is at a 100-year high

Zero Hedge, 20 April 2020

see:

www.zerohedge.com/commodities/whats-going-silver-market

The Chicago Fed's National Activity Index crashes into deep recession territoty

Zero Hedge, 20 April 2020

style="width:720px;height:540px;">

see:

www.zerohedge.com/economics/feds-national-activity-index-crashes-deep-recession-territory

SP500 mostly flat while the WTI Prompt Spread drops big, diverging down from their correlation

Zero Hedge, 20 April 2020

style="width:720px;height:540px;">

see:

www.zerohedge.com/markets/last-time-happened-oil-stocks-collapsed-30

17 of 20 SP500 valuation metrics above their historical averages, as despite recession, SP500 valuations at all time highs

Zero Hedge, 18 April 2020

see:

www.zerohedge.com/markets/fed-all-buyers-have-banks-agree-stocks-have-never-been-more-expensive

In the last 17 years, the Fed has gradually lost all power to boost economic growth, no matter how much money it prints and gives to rich people

Zero Hedge, 16 April 2020

see:

www.zerohedge.com/markets/time-might-be-different

5 stocks - Microsoft, Apple, Amazon, Google, Facebook - account for 21% of the SP500 - the most concentration in history

Zero Hedge, 16 April 2020

see:

www.zerohedge.com/markets/market-now-just-5-stocks-sp-now-more-concentrated-top-5-names-then-ever

While the Nasdaq 100 has tracked Nasdaq 100 Consensus 12m Fwd EPS for the last nine months or so, in March they diverged, indicating Nasdaq 100 is being pumped

Zero Hedge, 16 April 2020

see:

www.zerohedge.com/markets/nasdaq-100-surges-back-green-2020-small-caps-down-30

US retail sales, month-to-month, crash by most ever in March, despite hoarding

Zero Hedge, 15 April 2020

see:

www.zerohedge.com/personal-finance/us-retail-sales-crash-most-ever-march-despite-hoarding

Fed's Empire State Manufacturing index crashes most ever to -78, lowest in history

Zero Hedge, 15 April 2020

see:

www.zerohedge.com/economics/here-comes-depression-empire-state-manufacturing-crashes-most-ever-78-lowest-history

MSCI World stock index remains steady as the Citi Global Economic Surprise index plunges - which will regress?

Zero Hedge, 14 April 2020

see:

www.zerohedge.com/markets/im-no-epidemiologist

Home builders in real denial about dismal state of industry

Zero Hedge, 13 April 2020

see:

www.zerohedge.com/markets/builders-denial

Most profitable technical analysis trade since 1993 now works in reverse

Zero Hedge, 07 April 2020

style="width:720px;height:540px;">

style="width:720px;height:540px;">

see:

www.zerohedge.com/markets/most-profitable-trade-1993-now-upside-down

Half of all small businesses hold a cash buffer of less than on month

Real Investment Advice, 03 April 2020

see:

realinvestmentadvice.com/macroview-the-fed-cant-fix-whats-broken/

While the SP500 has tracked SP Consensus 12m Fwd EPS for the last year or so in March they diverged, indicating SP500 will continue to drop

Zero Hedge, 01 April 2020

see:

www.zerohedge.com/markets/trader-maybe-we-cant-handle-truth-after-all

SP500 market crash tracking crash of 2007/9 - indicating the drop to date will be doubled

Zero Hedge, 31 March 2020

see:

www.zerohedge.com/markets/too-early-still-too-high-goldman-sees-bear-bounce-not-market-turn

Copper/gold price ratio diverging down from 10-year Treasury yields, and copper prices diverges down from oil prices, two long term correlations suggesting copper prices (and the world economy) will continue to decline

Zero Hedge, 18 March 2020

see:

www.cnbc.com/2020/03/19/copper-prices-could-fall-further-amid-the-coronavirus-crisis.html

Bloomberg US Dollar Index at an all-time record high

Zero Hedge, 18 March 2020

see:

www.zerohedge.com/markets/what-12-trillion-dollar-margin-call-looks

Bloomberg US Dollar Index mostly rises during European trading hours

Zero Hedge, 18 March 2020

see:

www.zerohedge.com/markets/what-12-trillion-dollar-margin-call-looks

The SP500, despite the recent crash, has again diverged upward from the 30-year Treasury yield, leaving people split if the economy is still bearish

Zero Hedge, 13 March 2020

see:

www.zerohedge.com/markets/bmo-disconnect-between-treasuries-and-stocks-most-widely-debated-topic-moment

The SP500 has dropped 20% from peak faster than any time in history

Zero Hedge, 13 March 2020

see:

www.zerohedge.com/markets/rohrkrepierer-how-feds-giant-bazooka-misfired

style="width:1080px;height:540px;">

style="width:1080px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">

style="width:720px;height:540px;">